Estimated annual property taxes

Oldham County collects the highest property tax in Kentucky levying an average of 224400 096 of median home value yearly in property taxes while Wolfe County has the lowest property tax in the state collecting an average tax of 29300 054. In 1994 Save Our Homes SOH was enacted into law to protect Floridas homesteaded residents by limiting annual increases to a propertys assessed value to a maximum of 3.

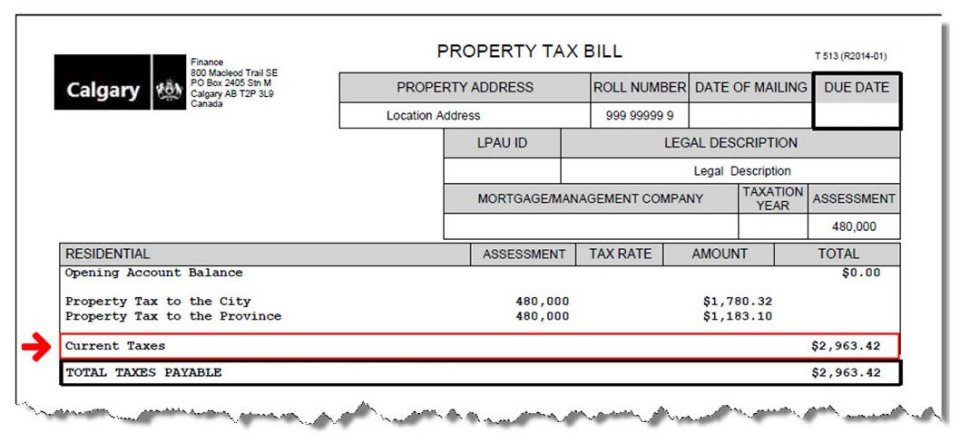

Property Tax Breakdown

Taxes for a 100000 home in.

. Search Any Address 2. If your county isnt among the selections available its because that county didnt provide us with its information. Thank you for your patience while we upgrade our system.

This estimate should not be relied upon as a definitive determination of annual taxes. Columbus - 100000 x 148 148000. Ad Property Taxes Info.

Multiply the market value of the property by the percentage listed for your taxing district. Get an estimate of your property taxes using the calculator below. The ASSESSED VALUE is 25000 25 of 100000 and the TAX RATE has been set by your county commission at 320 per hundred of assessed value.

To figure the tax simply multiply the ASSESSED VALUE 25000 by the TAX RATE 320 per hundred dollars assessed. Whitehall - 100000 x 172. We can only provide estimates for the counties listed in the drop-down menu.

A simple percentage used to estimate total property taxes for a property. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan. Last updated June 15 2022.

As the years of homesteaded ownership go by the market value of the home rises or falls but the assessed value of the home will never. 5 Infrastructure Maintenance Fee 500 max NA. See Property Records Tax Titles Owner Info More.

Total Estimated Property Tax Amount0. Begin Estimating Property Taxes. 25000 x 03200 80000.

25000100 250 x 320 80000. Select the county found on your assessment notice. Annual personal property tax based on vehicle value.

This estimate does not include any non-ad valorem fees that may be applicable such as storm water solid waste etc This calculator is intended to provide an estimate of the ad valorem taxes only. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. 46-116 Gross Vehicle Weight Fee.

Discover the Registered Owner Estimated Land Value Mortgage Information. 250 infrastructure fee if transferring registration. 60 biennial hybrid fee.

120 biennial EV fee. The exact property tax levied depends on the county in Kentucky the property is located in.

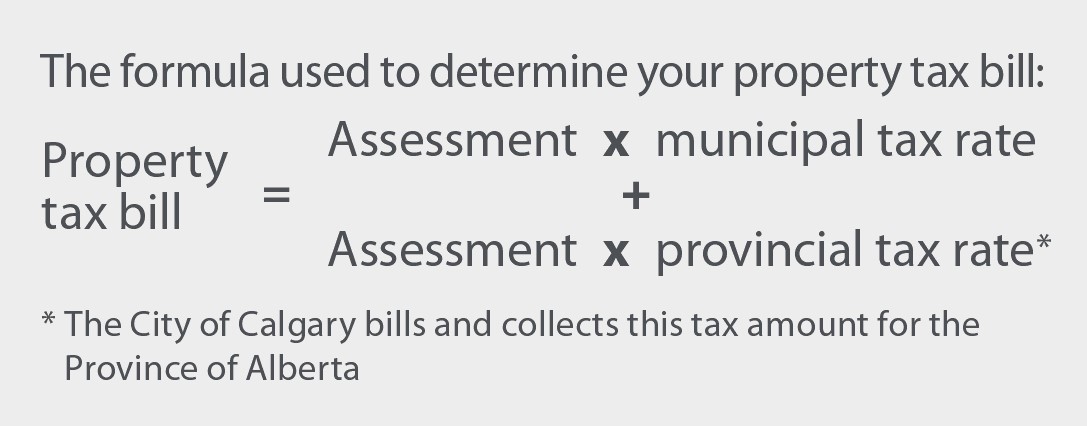

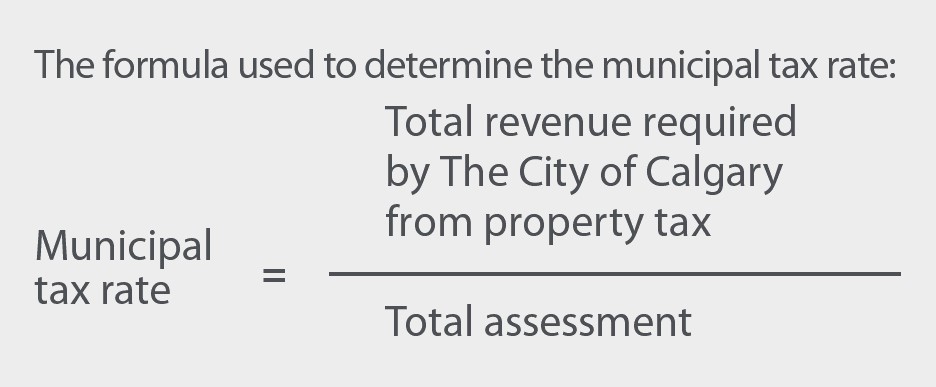

The Property Tax Equation

Property Tax Calculator

Costs Hi Desert Water District Ca

Property Tax Tax Rate And Bill Calculation

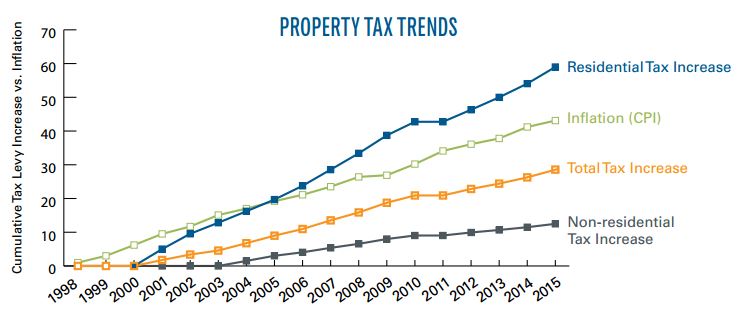

Property Taxes Property Tax Analysis Tax Foundation

Property Taxes Haldimand County

Property Tax Tax Rate And Bill Calculation

How To Calculate Property Tax And How To Estimate Property Taxes

City Of Brampton Taxes Assessment Taxes And Assessment

Property Taxes 101 Property Tax Formula

Understanding California S Property Taxes

Property Tax Tax Rate And Bill Calculation

Secured Property Taxes Treasurer Tax Collector

Ontario Property Tax Rates Calculator Wowa Ca

City Revenue Fact Sheet City Of Toronto

Property Taxes Coquitlam Bc

Propertytax